Photo credit: iStock, BasSlabbers

Donald Trump officially becomes U.S. president today, and will begin implementing his trade agenda.

He comes to office touting his plans for “creating jobs and wealth for American workers.” Canada’s best hope in resolving the escalating softwood lumber dispute is to use this to our advantage.

Canada has a very short window of opportunity to stress to the new administration how Canadian softwood contributes to U.S. economic growth, and how restricting its import will hurt most the very people who voted President Trump into office. The U.S Commerce Department is set to rule on countervailing and antidumping investigations into Canadian softwood lumber products in February and May, respectively. Its findings will almost certainly result in high duties being slapped on Canadian lumber imports.

Below are five messages about the softwood dispute Ottawa should press with the Trump administration:

1) Canadian softwood imports contribute to U.S. GDP growth

One of Trump’s major promises is to raise GDP growth to four per cent from one per cent a year. With the housing sector making up 15 to 18 per cent of GDP, it is no coincidence that during the 2008-09 recession, housing starts in the U.S. were at their lowest level in 40 years. When the housing market began to recover, so did the economy as a whole.

Canadian softwood lumber is already aiding the economic recovery below the border. U.S lumber demand exceeds domestic supply, and the vast majority (95 per cent) of its imports come from Canada. Housing accounts for about 40 per cent of U.S. lumber demand; restricting lumber imports will impede growth in the housing sector and affect overall economic growth.

!function(e,t,n,s){var i=”InfogramEmbeds”,o=e.getElementsByTagName(t),d=o[0],a=/^http:/.test(e.location)?”http:”:”https:”;if(/^/{2}/.test(s)&&(s=a+s),window[i]&&window[i].initialized)window[i].process&&window[i].process();else if(!e.getElementById(n)){var r=e.createElement(t);r.async=1,r.id=n,r.src=s,d.parentNode.insertBefore(r,d)}}(document,”script”,”infogram-async”,”//e.infogr.am/js/dist/embed-loader-min.js”);

2) Restricting Canadian lumber makes homeownership less affordable

Duties on Canadian lumber reduces competition for U.S. domestic producers, increasing the price of lumber. The U.S. National Association of Home Builders (NAHB) calculates that for every US$1,000 increase in house prices, about 153,000 families are priced out of purchasing a home.

U.S consumers paid a price of $6 billion for the duties prescribed under the recently expired softwood lumber agreement (SLA). These duties ranged from zero to 15 per cent, depending on the price of lumber. If the U.S. tacks duties on Canadian softwood products this spring, they could be as high as 25 to 40 per cent.

3) Import restrictions on softwood products cause job losses

A 25 per cent duty on Canadian lumber imports would result in close to 8,000 lost jobs in the U.S., according to the NAHB. Jobs losses wouldn’t only occur in the construction industry; related sectors such as transportation, insurance and real estate would feel the consequences. So would mattress manufacturers who use Canadian lumber to build bed frames.

While 8,000 jobs may not seem like a lot, President Trump made a big deal out of striking a deal with Carrier less than a month after the election to keep 1,000 factory jobs in Indiana.

Close to 30 per cent of the U.S. construction industry is Hispanic. While the president gained nearly 30 per cent of the Hispanic vote, it was still less than half the number of votes cast for Democrats. If he can visibly prevent jobs loses in the sector, he has a shot at cementing and growing his support among Latino voters and making it more difficult for democrats to gain back majorities in the House or Senate.

4) Canadian timber supply is decreasing

Since the 1990s, the mountain pine beetle has killed more than half of B.C.’s commercial lodgepole pine – the province that supplies more than half of all Canadian softwood exports to the U.S. In stark contrast, softwood production in all regions of the U.S. is increasing as housing starts rise. The continued import of Canadian lumber at status quo levels is not going to cause mill closures in the U.S. In fact, while more than 20 mills closed in B.C. since 2005, Canadian companies are investing in sawmills and creating jobs inside the U.S.

5) U.S. domestic market share is increasing

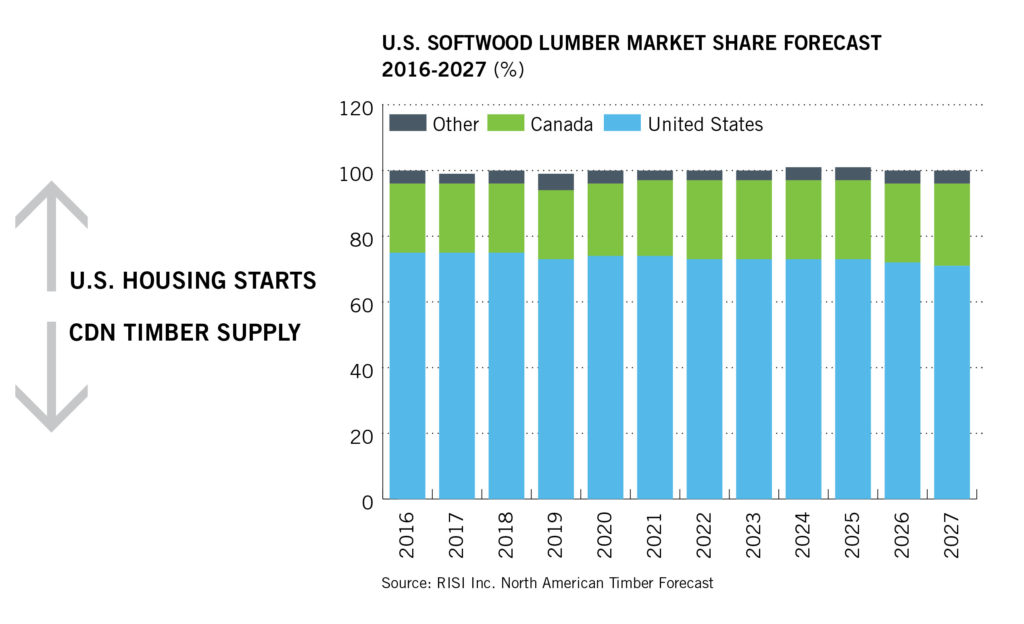

The last SLA capped Canada’s share of the U.S. lumber market at 34 per cent. Historically, Canada has occupied an average of 30 per cent. We currently hold about 27 per cent. Due to declining timber supply, a decade from now that is projected to drop to 25 per cent.

During the near-decade the SLA was in place, the U.S. share of its market increased 10 per cent, to 71 per cent from 61 per cent. Canadian lumber is not a threat to U.S. competitors, because we do not have the physical capacity to sustainably increase our exports.

The softwood conversation in Washington D.C. is dominated by industry lobbyists, namely, the U.S. Lumber Coalition. Yet these factors highlight that the big losers of import restrictions are regular U.S. citizens – President Trump’s power base of support. For an anti-establishment president, siding with everyday Americans over Washington lobbyists should be an easy decision.

Framing the issue in these terms is Canada’s best chance to reach a new softwood deal with the new administration. And it is critical to try to do so before the Commerce department imposes high duties on Canadian softwood in the spring.

– Naomi Christensen is a senior policy analyst at the Canada West Foundation