FIRST IN A SERIES ON CANADA’S TRADE AGREEMENTS

The recent Pacific Alliance summit has come and gone, with few Canadians taking notice.

That’s unfortunate because western business have many reasons to pay attention to the attractive market (pdf) the Pacific Alliance trade bloc represents. These include export opportunities, a growing middle class and opportunities in trade in services and investment.

In June, Canada became the first observer country to enter a strategic partnership with the trading bloc when it signed a joint declaration on partnership with the Pacific Alliance. We already have individual trade agreements with each member country (Chile, Peru, Colombia and Mexico) and Canada is an observer nation in the Alliance, but the new partnership goes a step further. It identifies six areas for increased co-operation, including trade and responsible natural resource development. This framework will allow for longer-term co-operation on issues that are important to both Canada and Pacific Alliance members, with a particular focus on small- and medium-sized businesses.

As western Canada looks across the Pacific for new trade opportunities, the commitment by the leaders of the four Pacific Alliance countries to strengthen their own economic integration is also a welcome development.

Formed in 2011, the Alliance has several notable achievements: creating a joint stock exchange; eliminating visas for travel and work among member countries and creating a common visa for external visitors; working on one-stop-shop initiatives for foreigners looking to do business in the Alliance; and implementing common rules-of-origin regulatory harmonization.

As these initiatives are implemented, it will become easier for Canadian businesses to trade with and invest in all PA countries; in essence, getting “four for the price of one.”

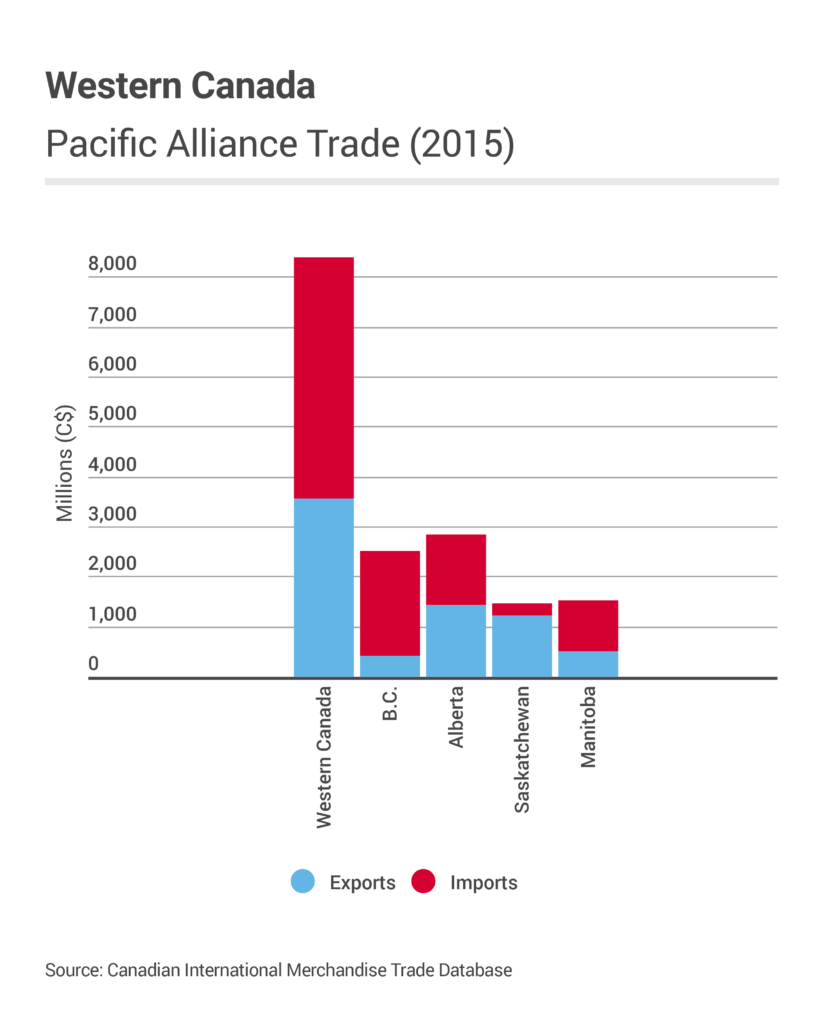

Trade opportunities

If the Pacific Alliance were a single country, it would be the world’s 9th largest economy. Its members account for more than 37 per cent of Latin America’s gross domestic product. Combined, the four countries have a GDP of just under US$2 trillion, with Mexico making up about half. The Alliance represents more than one-third of Latin America’s population.

The Pacific Alliance accounts for 46 per cent of Latin America’s exports and 50 per cent of its imports. Canada already has strong trade links with the bloc; more than 70 per cent of our two-way trade with Latin America is with Pacific Alliance countries.

The top three western Canadian products exported to the Pacific Alliance are:

- Wheat and rapeseed.

- Swine and bovine cuts.

- Machinery

Attracting foreign investment into the bloc is a key focus of the Alliance. The trade promotion agencies of the member countries work together to promote exports and tourism and attract foreign direct investment.

Canada’s major competitors (pdf) in the region include Spain (in banking), Australia (in mining and mining equipment) and the United States (in everything!). Like Canada, these countries all have trade agreements with the Pacific Alliance countries. However, Canada is the first country observer country to sign a partnership declaration with the PA.

For western Canada in particular, the Alliance also presents an opportunity for trade in services; for example, the export of Alberta’s oil and gas technologies and expertise to Colombia, considered one of the best South American economies for oil firm investment. Canada already conducts more two-way trade in services with the Pacific Alliance than with China, providing a good base to build on.

Other service opportunities include establishing regional supply chains to trade with Asia and for natural resource development.

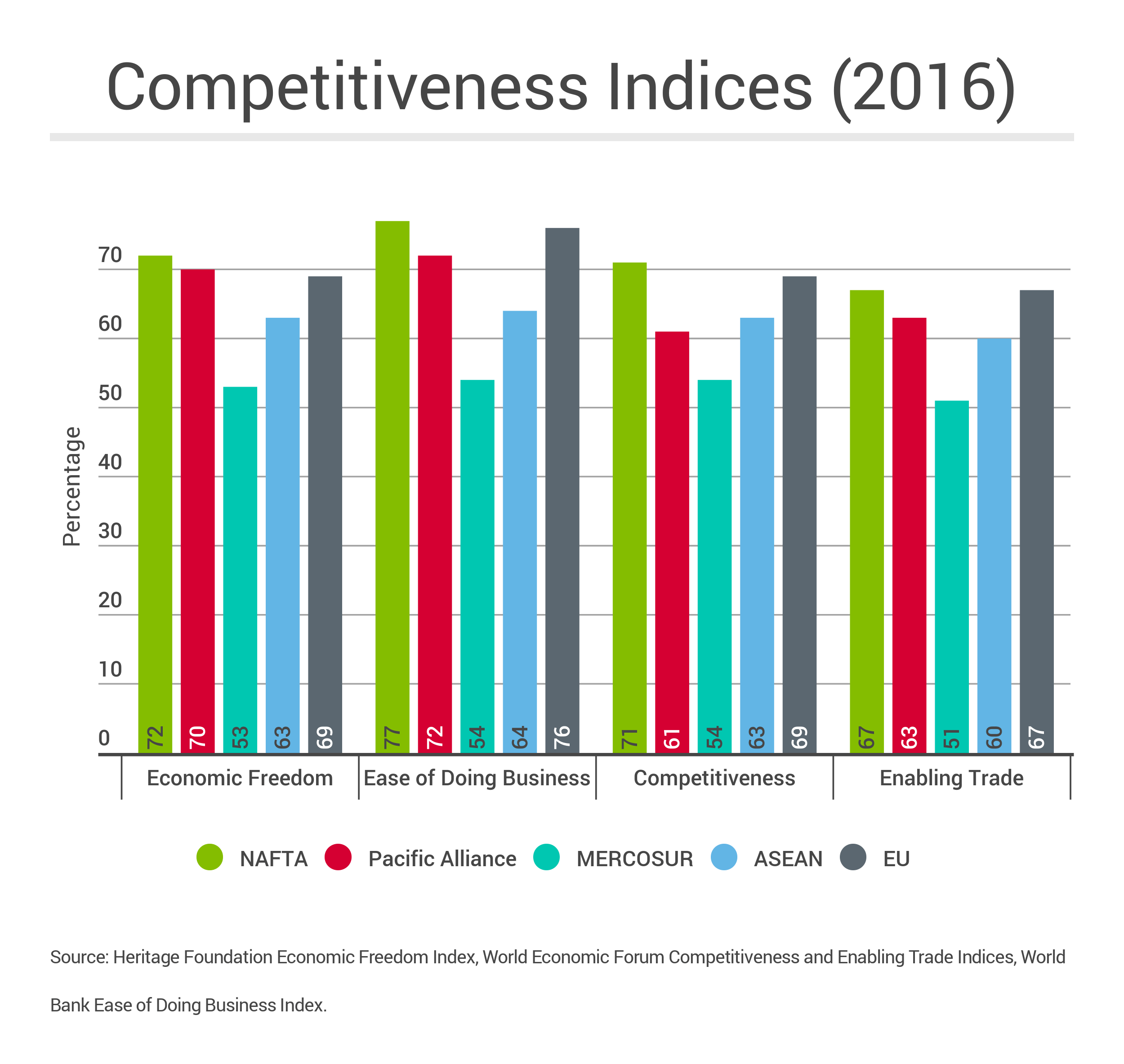

The Pacific Alliance countries are attractive markets because they are mature and stable democracies, pro-trade, and have sound macro-economic fundamentals. All rank in the top third of the World Bank’s Ease of Doing Business Index (pdf). Chile and Mexico are members of the OECD and Colombia is joining. While other trade blocs such as the EU, Mercosur (Argentina, Brazil, Paraguay and Uruguay) and NAFTA have faltered or gone backwards, the Pacific Alliance has progressed because of its pragmatic focus on competitiveness issues over politics.

Pacific Alliance countries and western Canada share a desire to move away from over-dependence on trade with the U.S., making increased trade with each other appealing.

This is the first of a four-part series on western Canada’s trading relationship with global trade blocs. Watch for reports on western Canada’s trade with NAFTA, ASEAN and MERCOSUR.

– Naomi Christensen is a policy analyst at the Canada West Foundation