China Brief: China, the Indo-Pacific and Canada’s West

Issue 103 | June 2024

In this issue: Xi Jinping brings agriculture market access gifts to France, Saskatchewan’s India Trade Office, a new Mexico-to-Asia trade route and more!

President Xi Goes Paris… and advances agricultural issues!?

Chinese President & General Secretary of the Chinese Communist Party Xi Jinping was in France earlier this month bringing with him a flurry of announcements, including some positive signals for French agricultural exporters (which will be of interest to Western Canadians).

But that’s the surface level take, you don’t have to probe much deeper to see some political jockeying in Xi’s first European sojourn since before the pandemic. And when it comes to market access deals with China the proof will come only later as trade data becomes available.

Geopolitics, trade carrots and the cleantech fight

Xi’s visit didn’t take place in a vacuum. From hot wars to trade wars, there’s a growing list of geopolitical flashpoints around the world where near-term Chinese actions will impact the shape of an emerging order. One issue close to European hearts (and borders) is the ongoing Russian invasion of Ukraine.

In the build-up to U.S. Secretary of State Anthony Blinken’s April visit to China, U.S. officials released information detailing Chinese equipment exports to Russia that the Americans believe are feeding into the military industrial complex. Such news was not welcomed in Europe, and indeed this was an issue that Macron unsuccessfully pressed Xi on. According to Politico EU “what Macron got was a tin-eared Xi, who either denied there were any problems, offered modest concessions that required very little sacrifice on China’s part, or outright misrepresented China’s involvement in Russia’s war on Ukraine.”

While interests on Ukraine unsurprisingly didn’t align, there was closer alignment on another geopolitical issue: balancing against U.S. influence. Granted, Macron has a very different vision in mind here than Xi. France is keen to drive the EU bus and it can’t stand having the available routes being constrained by the U.S. Aware of France’s desires for European ‘strategic autonomy,’ Xi was happy to dangle a few carrots to encourage this trend. And politically aware China knows just where to plant these carrots: Europe’s agricultural garden.

Agriculture is a sensitive sector in France – and the broader EU – tensions have been high with a raft of protests taking over the continent this year. This served as part of the backdrop when at the end of April the EU Agriculture Commissioner visited Beijing to discuss market access – and to fend off potential Chinese retaliation targeting the already volatile EU ag sector and its protesting farmers.

And the EU has good reason to be fretting about potential Chinese retaliation amidst the growing cleantech fight (see China Brief 102 for more on this!). As the EU launches investigations and threatens tariffs into the key sectors of this battle, they know that China has a penchant for retaliation and agricultural imports are an easy target as national phytosanitary regulations allow for plausible deniability. Hence, the Commissioner sought to portray agriculture as a strategic sector that should be immune from the fallout over the cleantech saga.

Break out the champagne… errr cognac!

When the EU launched one of the first salvos against Chinese EV’s last year, China ‘coincidently’ launched an investigation targeting French cognac. China is an important market for luxury products and cognac is no exception; it accounted for 19.4 per cent of French cognac exports in 2023. Hence, Macron was pleased as spiked punch to announce a minor concession from Xi in the form of a promise not to implement provisional measures (additional taxes or custom duties) during the investigation period. This, of course, leaves open the possibility for China to implement tariffs pending the investigation’s results, which may depend more on the blooming of France’s strategic autonomy than the political economy of the French cognac industry.

This wasn’t the only announcement leaders clinked glasses over. The EU won market access for French pork offal, which could increase pork exports by 10 per cent in a market where its pork exports were already valued at 260 million euros in 2023. Processed pork protein used for feed has gained access. A few French chickens were spared the guillotine as China agreed to ban imports only from areas with reported bird flu outbreaks instead of the entire country.

Just in case other countries were watching in envy, The Global Times, a Chinese state-run media outlet, wasn’t so subtle in suggesting that France’s approach holds lessons for at least the U.S. The article asserts that “U.S. trade policy toward China, has hindered the potential for trade complementarity between the two countries” and that “China’s booming agricultural trade with France could serve as a reminder that the U.S. needs to rethink its trade strategy toward China to get agricultural trade with China back on track, and on the right one.” While taking aim at the U.S., we could easily imagine such talking points directed at Canada.

Saskatchewan takes the lead, set to re-open its Indian trade office

Amidst the ongoing challenges in Canada-India relations, the Saskatchewan government announced the re-opening of its Indian trade office in New Delhi and diplomatic accreditation for its Managing Director.

This news would’ve raised some eyebrows in Ottawa, as its diplomats are still not allowed to serve in India. This was the geopolitical aftermath following Prime Minister Trudeau’s high-profile allegations in the House of Commons that India was behind the assassination of a Canadian citizen who was a leader in a Sikh separatist movement. This came on the heels of a steady stream of irritants in an already sensitive sticking point in the relationship (such as a parade float in Brampton, ON that appeared to glorify the assassination of an Indian prime minister and a publicity stunt ‘referendum’ on separation). India didn’t take long to respond by denying the allegations and giving 41 Canadian diplomats the boot.

This murder is inexcusable regardless of who committed the crime, but this shouldn’t deter us from scrutinizing the Canadian approach to managing relations. Contrast the Prime Minister’s announcement, which was reportedly driven by trying to get ahead of a news story, with the U.S. approach on a similar issue. U.S. allegations were part of a formal judicial process where indictments were unsealed and released to the public. The criminal indictment was, of course, coupled with charges and a release of details. Such an approach included behind the scenes discussions between U.S. and Indian officials, prompting a very different response from New Delhi when the allegations went public.

While Canadians are rightfully concerned about the allegations, it’s also important that we think about our international relationships in a way that incorporates a broad range of interests. Given that Saskatchewan’s exports to India were $1.3 billion (out of $5.1 billion total Canadian exports) in 2023, the provincial government understandably wants to clear avenues for dialogue and economic engagement. In general, the province has been active in pursuing its interests abroad, something that has won the accolades of former Prime Minster Stephen Harper (note that Trade Minister Harrison signaled this approach in his contribution to our China Brief 100 issue!)

The Globe and Mail is correct that Canada-India relations aren’t normal right now. But we need to remember that diplomacy isn’t about summer barbeques with your pals. It’s about managing relations and its real value comes during difficult times. This doesn’t imply that the government should brush off the alleged infringement on Canadian sovereignty, but nor should the response derail relations.

This demonstrates how difficult and complicated engagement will be for Canada in the Indo-Pacific. If Canada has made a ‘generational investment’ via the Indo-Pacific Strategy, it will have to learn play the long game. Saskatchewan’s approach should then be welcomed as it has clearly become incredibly difficult for the federal government to engage right now. The province helps to maintain a modicum of government relations with an important economic and geopolitical partner. India is in the early stages of an economic boom that will re-write our understanding of Indo-Pacific region; indeed, governments around the world used this moniker to re-brand the Asia-Pacific precisely to recognize India’s growing weight and geopolitical clout. Trade with India continues with room for growth, therefore someone has to mind the shop. India too has welcomed the engagement from the province.

The ongoing media attention on this issue will create more obstacles to forging a closer relationship at this critical time. India won’t benefit from this either and is perhaps hoping that Saskatchewan’s step will help prepare for the eventual normalization of relations.

In case you missed it!

Clean Tech Tariffs (and then some)

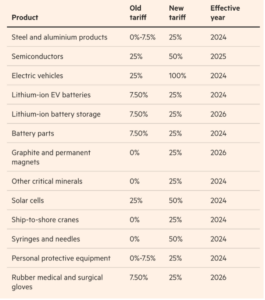

President Biden announced new tariffs on Chinese imports. These tariffs flow from the same Section 301 investigation released by the Trump Administration way back in 2018 that laid the justification for unilateral U.S. trade action ushering in the U.S.-China trade war. Title III of the U.S. Trade Act of 1974 (which we know as ‘Section 301’) grants the U.S. government the legal right to impose punitive measures on trading partners that it believes, as demonstrated through a USTR investigation, are engaging in “unfair” trading practices. There is a statutory four-year review to determine whether such measures stay in place, which in this case was initiated back in 2022 with the report dropping on May 14. These findings gave the legal rationale for the latest round of tariffs.

The report acknowledges that “evidence indicates that the imposition of section 301 tariffs, or threat thereof, has induced China to take steps toward eliminating some of its technology transfer-related acts, policies, and practices,” but according to USTR Catherine Tai, “further action is required.”

And her actions speak to the political economy of the day. Clean-tech, and notably the 100 per cent tariff on EVs, signal Biden’s priority for the emerging new auto supply chain. PPE and related minor medical devices hark back to the mad global scramble for supplies during the pandemic. And the tariffs for ship-to-shore cranes reflect some recent stories about port security and data breaches.

Source: Bloomberg

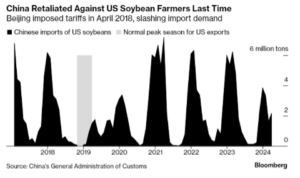

But the thing about trade policy is that two can tango. Sure, the U.S. may be able to cook up domestic legal tools that enable unilateral action, but other countries can respond. China may well try to dress up its retaliation when it’s tied to an unrelated political dispute, but it doesn’t need the ambiguity for tit-for-tat measures. Chinese trade weapons typically target important political constituencies that export either non-strategic or luxury goods (comment ca va cognac?) or substitutable commodities. Precedent can also give clues to which tools in the policy toolbox are reached for, here U.S. farmers will be watching soybeans. Soybean trade was hit hard when the Trump tariffs were launched, though U.S. exports rebounded when the Phase 1 deal was inked. This coincided with an increase in exports from substitute markets. However, even with this in mind the distribution of economic pain is likely to fall harder on China. Its economic troubles make it vulnerable to an external demand shock, which would be exacerbated given the real possibility of similar restrictions in other key markets like the EU.

¡Viva el comercio con China! New trade routes follow Chinese firms nearshoring to Mexico

Mexico offers a live example of how trade policy can re-structure trade and investment patterns. Trump’s wide-scope tariffs against China have slowly but surely caused a shift in trade and investment to Mexico. Mexico’s economic relations with China have ramped up as the latter seeks to avoid U.S. tariffs by increased trade and investment into Mexico. Investments in manufacturing and processing facilities enable Chinese-made components to be shipped to Mexico for final assembly thereby gaining the market access offered by the USMCA.

To support this growing trade, new Asia-to-Mexico trade lanes were recently established by several global shippers. To facilitate the business travel that’s needed to scope out and manage projects, an air route connecting China to Mexico was re-established after a pandemic-induced hiatus.

It’s hard to say how long this unintended near-shoring will last; the U.S. is pressuring Mexico on incentives in EV sector. If the U.S. deems that this tariff workaround is threatening its interests, it could use the scheduled USMCA review in 2026 to apply additional pressure on Mexico.

- And at last, Canada’s first TMX shipment to China! Canada’s first TMX shipment to China left Vancouver chock full of 550,000 barrels of diluted bitumen.

- Values and interest headwinds in Vietnam? A new report by Project 88 recommends governments who are gung ho on Vietnam to “rethink the prevailing assumptions underpinning their policy.” The authors point to human rights issues and close alignment with China as some of the reasons for caution.

- U.S. tightens the seams on textile imports from China, further highlighting how it’s not just semiconductors, dual-use and cleantech where the U.S. is restricting engagement. The Department of Homeland Security added 26 new companies to its entity list Uyghur Forced Labor Prevention Act Entity List.

Jeff Mahon, Executive in Residence, Trade and Trade Infrastructure

The China Brief is a compilation of stories and links related to China, the Indo-Pacific and relationships with Canada’s West. The opinions expressed in the links are those of the articles’ authors and don’t necessarily reflect the views of the Canada West Foundation and our affiliates.