In this edition – We take a deep dive into China’s ban of canola imports, and what this could mean for Canada.

“Everything goes back to relations between China and Canada. Look at the volume of canola and canola oil China imported from Canada in the past. It’s huge. How could that be cut so much overnight? There must be political influence.”

– Fu Zhenzhen, senior agriculture analyst, Aige Agriculture

One Big Story: China bans Canadian canola imports

Canadian canola industry representatives

have announced that China has stopped purchasing Canadian canola seed.

The Canola Council of Canada, Canada’s

largest canola industry association, released a

news release on Thursday, March 21, that said: “While there was some

initial optimism that Chinese concerns with canola trade could be resolved

quickly, technical discussions to date have not indicated an immediate

resolution is possible. Canola seed exporters report that Chinese importers are

unwilling to purchase Canadian canola seed at this time.”

Until recently, canola exports to China

remained stable. But a few weeks ago, Chinese officials announced that they removed

the canola export license from Canada’s largest exporter of canola to

China, Richardson International. Chinese officials said that customs officials

discovered pests in samples of canola imports from Richardson, but the Canadian

Food Inspection Agency has

not been able to find any pests in the canola.

Additionally, strict

customs inspections are being applied to a wide range of other Canadian

agricultural exports to China, such as wheat and peas.

While motive for this is not explicitly

clear, many

analysts argue that this is an attempt to send a political message

regarding the detention of Meng Wanzhou.

Why is canola so important?

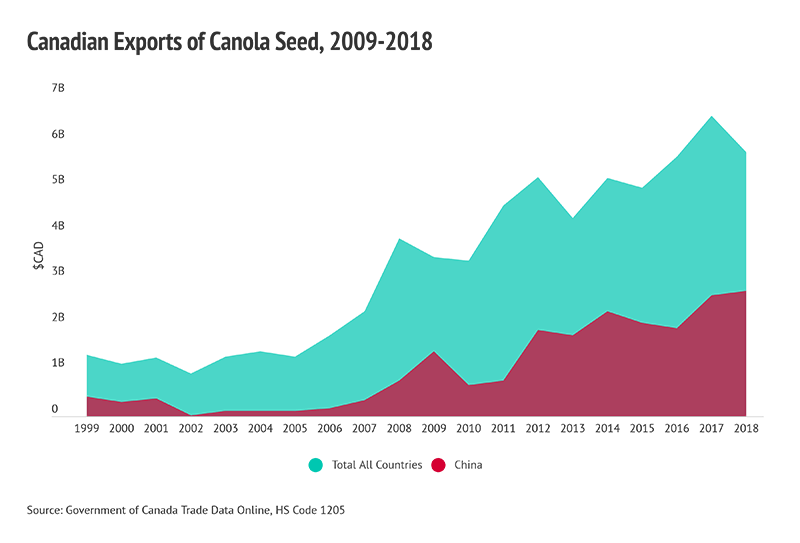

• Canola is one of Canada’s largest exports to China. In 2018, Canada exported more than $2.7 billion worth of canola to China, nearly half of Canada’s total canola exports.

• Canola is particularly important to Western Canada – almost all canola is grown in the three prairie provinces, and it has significant economic impact for all three. The Canola Council of Canada calculates that the Prairie provinces see a yearly economic benefit of more than $23 billion (with a country-wide economic benefit of $26.7 billion).

Implications:

• Canada’s political relationship with China has been on tenterhooks for months now, but until now we have not seen much in the way of economic fallout.

• While canola is Canada’s most important agricultural export to China, the implicit threat against other agricultural exports (from the “heightened inspections”) is certainly cause for concern.

• While canola is Canada’s most important agricultural export to China, the implicit threat against other agricultural exports (from the “heightened inspections”) is certainly cause for concern.

• This is likely going to be hard for farmers: one farmer has described the situation as “it means there’s going to be a lot less money for raising a family.”

From our shop:

• Trade Policy Economist Sharon Zhengyang Sun published (a very timely!) piece in the Hill Times about how Canada can cope with Chinese market access roadblocks to agriculture. She argues that Canada needs to engage with China “more comprehensively on non-tariff barriers that hinder agricultural trade… [which] could help provide certainly, predictability, and some transparency for businesses in terms of resolution timeline, procedure, and results.”

In other news:

• Italy is the first country to become part of China’s Belt and Road Initiative in Europe; Italy resisted pressure from the EU and the United States in doing this. This threatens to deepen rifts that Italy has with its traditional allies, and represents a major inroad for China’s massive project.