By Sharon Zhengyang Sun

Published in iAffairs

Our recent report, When interests converge: Agriculture as a basis of re-engagement with China, argued that despite troubled bilateral relations overall, the significance of the Chinese market for Canadian agriculture is expected to continue to grow. We noted that despite the challenges with Canadian canola and soybean exports to China in 2018-2019, exports of other agricultural products such as wheat, barley and peas actually increased during the same period. In fact, our report projected Canadian agricultural exports to China in 2020 well above 2017 levels, almost reaching the all-time high of 2018 levels that followed the signing of the 2016 MOU with China to address canola market access.

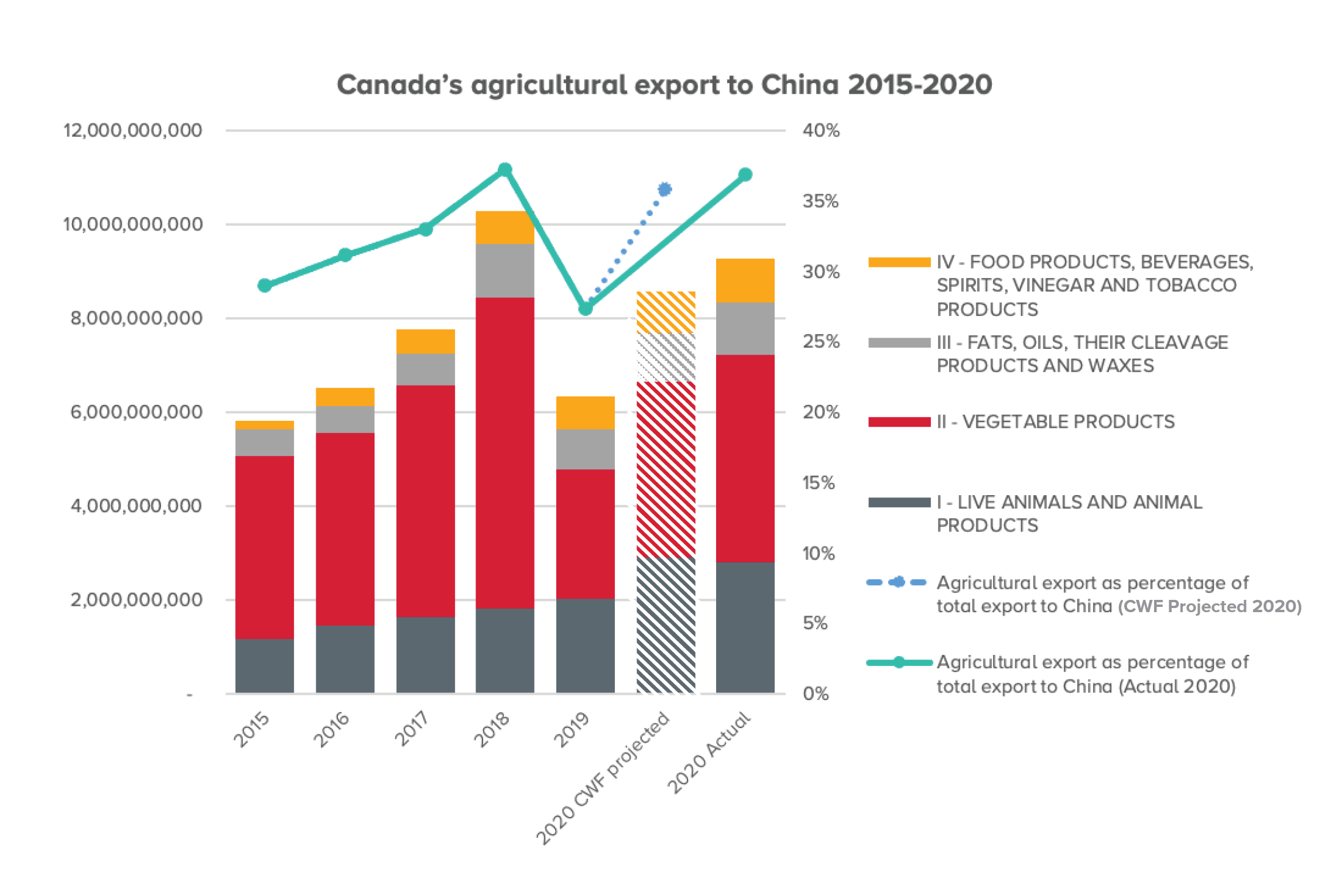

This just in: new 2020 Statistics Canada trade data shows Canada’s agricultural exports to China climbed even higher than what we projected in our report. This is great news for Canada (refer Figure 1a).

Canadian agricultural reality with China in 2020[1]

In our report, we used trailing 12 months (TTM) with only 7 months of data available at the time, to project that Canada’s 2020 agricultural exports to China would increase $2.2 billion (35% growth from 2019) for a total of $8.6 billion in agricultural exports to China. The new Statistics Canada’s 2020 data shows that Canada has actually exported $9.3 billion in agricultural exports to China. That is 46% growth from 2019, 11% more than we projected. (See Figure 1)

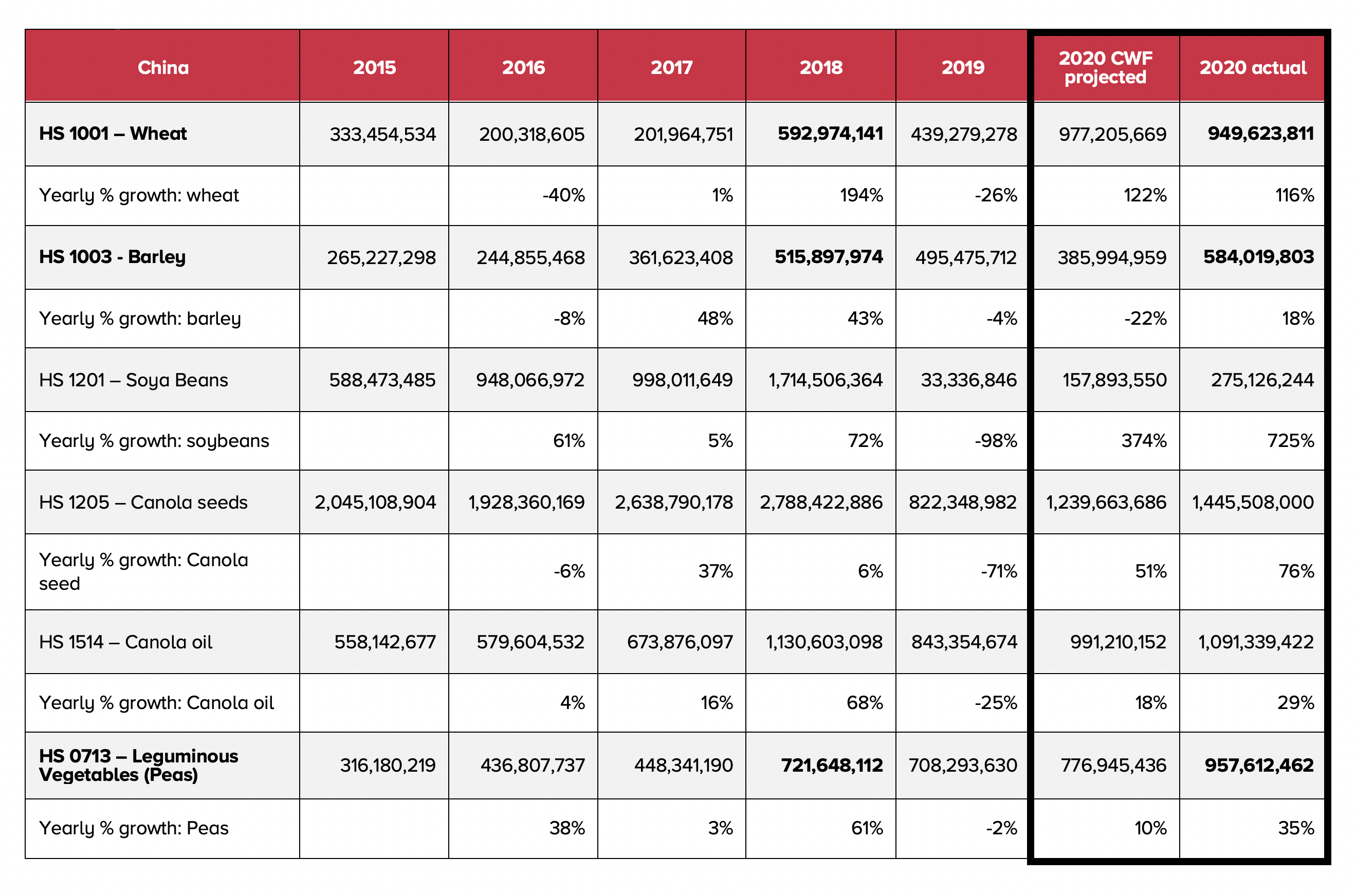

Statistics Canada’s new data confirms our projection that the majority of the 2019-2020 agricultural recovery is mainly driven by vegetable products[2], followed by fats and oils, and food and beverage products. It shows 2019-2020 growth of 62% for vegetable products exports compared to our 37% projection, in particular, due to the growth of wheat, barley, soybeans, canola seeds, peas and in the fats and oils category, canola oil. In fact, wheat, barley and peas exports have exceeded Canada’s 2018 all-time-high export levels of these products by $257 million, $68 million, and $236 million respectively (see Figure 2). Soybeans, canola seeds and canola oil have all regained momentum, although they have not fully recovered to 2018 levels. Finally, while canola may have dominated headlines, animal product exports between 2018-2019 and 2019-2020 quietly and steadily grew, achieving an all-time high in 2020.

FIGURE 1: Canadian agricultural export to China by HS category from 2015 to 2020 (in CAD current)

FIGURE 2: Key products under the Vegetable Product and Fats and Oils HS Category that contributed to Canadian agricultural export recovery between 2019-2020

Note: the bolded numbers within the table of Figure 2 emphasize which products have exceeded Canada’s 2018 all-time high export with China in 2020.

Data source for two figures: Trade Data Online, Statistics Canada, 2021; 2020 projection done by Canada West Foundation. Refer to report “When interests converge: Agriculture as a basis of re-engagement with China”, for more details.

Our When Interests Converge report recognized the signs of Chinese economic recovery and predicted the likelihood of sharp increases in consumption by China. These encouraging economic signs gained momentum heading into the end of 2020 even as the rest of the world continued to experience sluggish economic growth due to the COVID-19 pandemic. But we did not anticipate just how robust China’s economic recovery would be and what that would mean for the demand of Canadian agricultural products in Q3 and Q4 of 2020.

We’ve previously shown through our analysis of OECD projections that China will become the largest consumer by 2028 for some of the key agricultural goods which Canada produces. The better-than-expected growth revealed in the latest Statistics Canada data further demonstrates both China’s ability to recover and its purchasing power. The volumes reinforce why the market remains critical economically for Western Canadian agricultural producers. Canada would benefit from continuing to engage China on agricultural trade to address both tariff and more importantly, non-tariff barriers in agricultural exports with China.

One wakeup call is China’s recent move to leave Canada off of its list of new allowable agricultural import items from its updated List of Countries Permitted to Export Grains and Raw Plant-based Fodder to China – see my recent blog. Another is the recent discussion of the likelihood of China to meet the Americans’ unrealistic two-year purchase commitment for specific agricultural products (such as soybeans) under the U.S.-China Phase One Agreement. This coupled with the structural agreement in addressing some of the non-tariff barriers that Canada faces with China increases competition for Canadian agricultural export to China. Our allies, who are also our competitors, continue to engage and work for direct access to the Chinese market while addressing agricultural non-tariff barriers. Canada needs to do the same.

The interest in agriculture is not a one-way street for Canada when it comes to China. China also has serious interests in Canadian agriculture. China needs assurance of food security and reliable quality swing producers that do not use food as a weapon. Canada seeks market access certainty. These new data further confirm Canada West Foundation’s findings that identify agricultural trade as a key area of convergence of interest between Canada and China.

[1] All numbers are expressed in current Canadian dollars unless otherwise specified

[2] Vegetable products refer to cereals, grains, oilseeds, fruits and other field crops

Photo by Jonathan Petersson on Unsplash